Financial Solutions for Certified Public Accountants

Worry about your client’s financials, not your own

If you operate one of the 52,700 CPA firms in the US, you are navigating the seasonal demand that tax time brings, as well as continuously acquiring new clients and managing relationships with existing clients. Moreover, if you’re one of the 36,000 owner-operated firms with no employees, it can be especially tough to manage your workload.

We work with CPA firms and solo-preneurs in the accounting field every day and understand your unique needs. Let us partner with you to ease the burden of worrying about your own financial position and help you get back to what you’re best at doing: helping your clients with tax prep, auditing and bookkeeping.

Challenge: You Need to Manage Cash Shortfalls During Slow Seasons

CPA firms are easily one of the most well-known seasonal businesses. While February through May can stretch you to the limit, the summer months leave you wondering if you can manage cash flow for the remainder of the year.

Ask yourself these questions:

- How do you monitor your cash balances on a regular basis?

- How do you meet payroll and other expenses during periods of slow demand?

How we can help you:

- Lines of Credit to help you navigate ebbs and flows in your available cash throughout your seasons.

- Business Online and Mobile Banking, so you can monitor and track your cash balances anytime, anywhere.

Challenge: Improving Staff Productivity and Client Confidentiality

Since CPA firms basically sell the time and expertise of their professional staff, profitability is driven by the utilization rate of the staff’s time and the billing rate they realize for that time. Many firms are making investments in information technology, such as knowledge systems and mobile computing, to improve the productivity of their employees. Likewise, investments should be considered for technology initiatives to manage data, secure the IT environment, and manage IT risks and compliance.

Ask yourself these questions:

- How often do you update your technology solutions?

- How do you finance investments in practice management systems and technology upgrades?

- How do you keep up with the latest software for tax returns?

How we can help you:

- Lines of Credit to help you navigate ebbs and flows in your available cash while you work to improve efficiency and security.

- Term Loans to give you the working capital you need to acquire software, hardware and practice management systems.

Challenge: Reducing Collection Issues for High Volume of Tax Services

Tax preparation and planning is the bulk of a CPA firms’ business, representing upwards of 50% of revenue for most firms. Collecting on a high number of clients for these services can be problematic. Collection periods range from 38 to 51 days, though a significant amount of receivables can extend over 90 days. Providing easy, streamlined payment solutions can help lower collection periods.

Ask yourself these questions:

- How many individual and small business tax returns do you typically prepare?

- Do you accept credit cards for payments by clients?

How we can help you:

- Merchant Services to allow you to accept debit and credit card payments from clients, reducing the processing times for payments and improving receivables.

Talk To A Business Banker

Our knowledgeable Business Bankers are available to help answer any of your questions. Get started by choosing a Business Banker below.

Call Rhonda

423.262.4323

Call Pete

423.262.4322

Call Michael

423.857.2208

Call Stephen

423.262.4321

Call Lynn

423.857.2202

Call Wes

423.857.2206

Call Jenny

423.857.2215

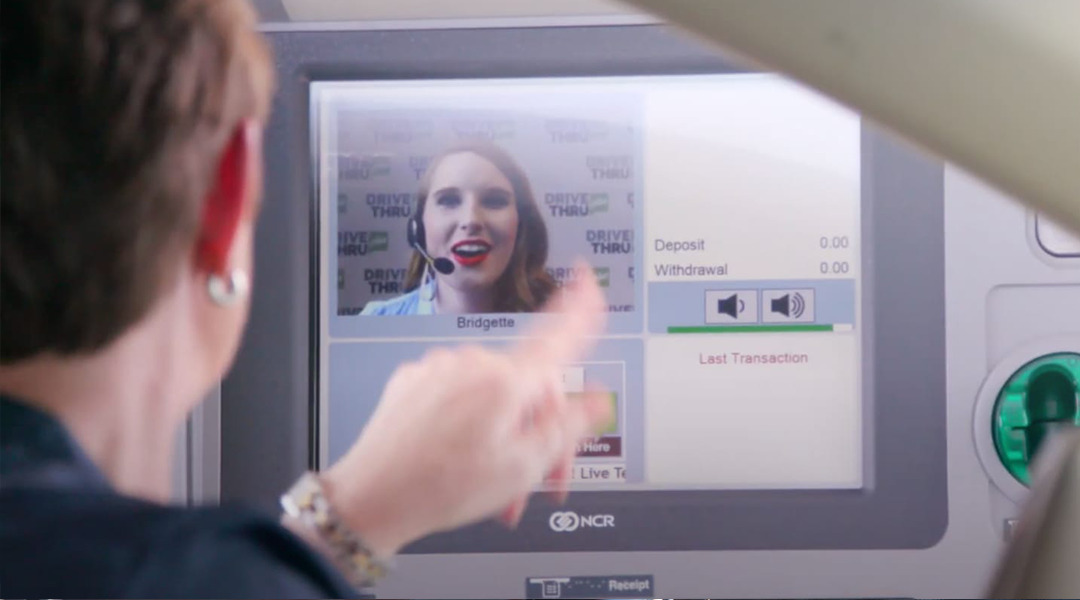

At Your Service

At Your Service DRIVE THRU plus

DRIVE THRU plus