- Personal

- Business

Introducing Business Insights

This complimentary set of tools is designed to assist you in effectively managing your finances and planning for the future requirements of your business.

Learn More- Mortgage

Mortgage- Purchase

- Apply Online

- Refinance

- Apply Online

Home Improvement Loans

Transform your house into your dream home with a home improvement loan.

Learn More- Wealth

Wealth Management- Explore

- Comprehensive Service

- Find an Advisor

- Investments are not insured by the FDIC; are not deposits; and may lose value.

- Manage

- Access LPL Account View

- Perspectives

- Locations

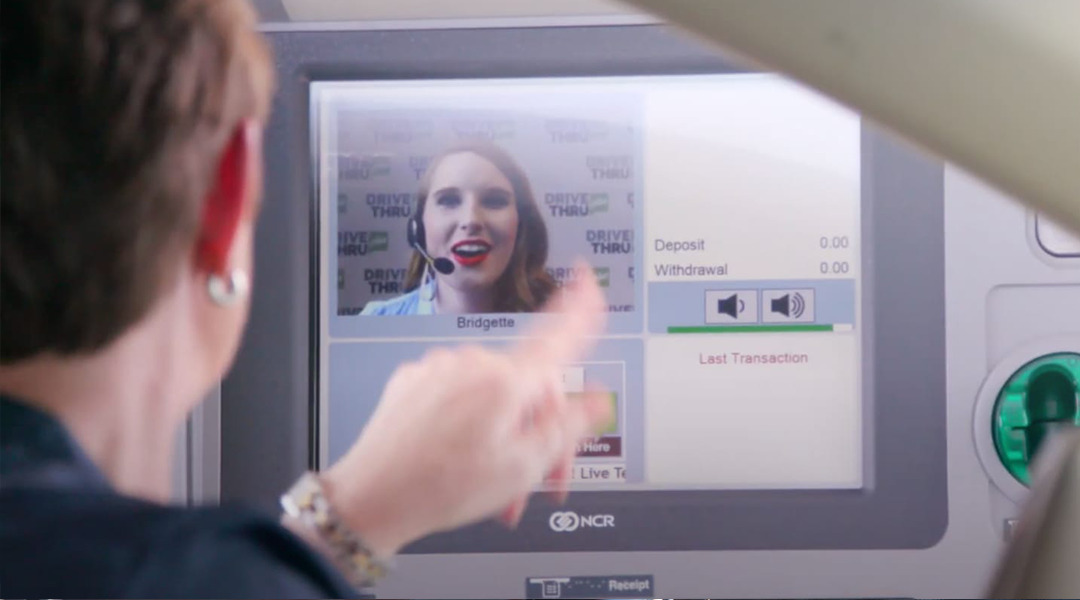

DRIVE THRU plus

DRIVE THRU plusOpen 12 hours a day, six days a week. (Yes, even on Saturday).

Discover DRIVE THRU plusConfidential and sensitive information such as account numbers should not be communicated via email. - Mortgage

At Your Service

At Your Service